Complete guide to obtaining and using a National Tax Number (NTN) in Pakistan. Learn about the application process, required documents, tax compliance, and more.

National Tax Number (NTN)

The National Tax Number (NTN) is a pivotal tool in Pakistan’s tax system, ensuring transparency, efficiency, and legal compliance in the economic activities of individuals and businesses. Issued by the Federal Board of Revenue (FBR), it is required for all entities participating in taxable transactions, and it plays a key role in fostering good governance and tax compliance.

For further details you can visit National Tax Number (NTN) in Pakistan

How to Register NTN?

To apply for a National Tax Number (NTN) in Pakistan, you can follow a simple step-by-step process through the IRIS portal (the FBR’s online system) or manually at a Regional Tax Office (RTO). Here’s a detailed guide on both methods:

Applying Online via IRIS Portal (Preferred Method):

Here is a step-by-step guide on how to get National Tax Number (NTN) online via IRIS 2.0:

Create an Account on IRIS:

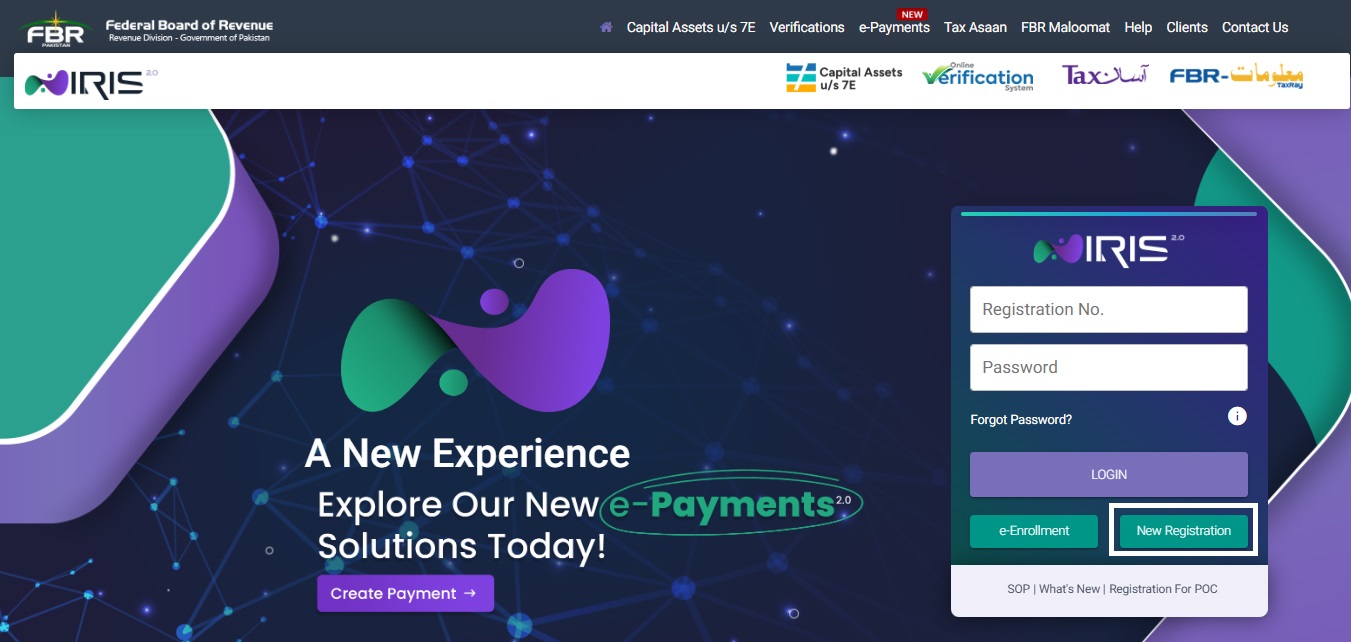

- Visit the official IRIS 2.0.

- Navigate to the Bottom Right section and select New Registration.

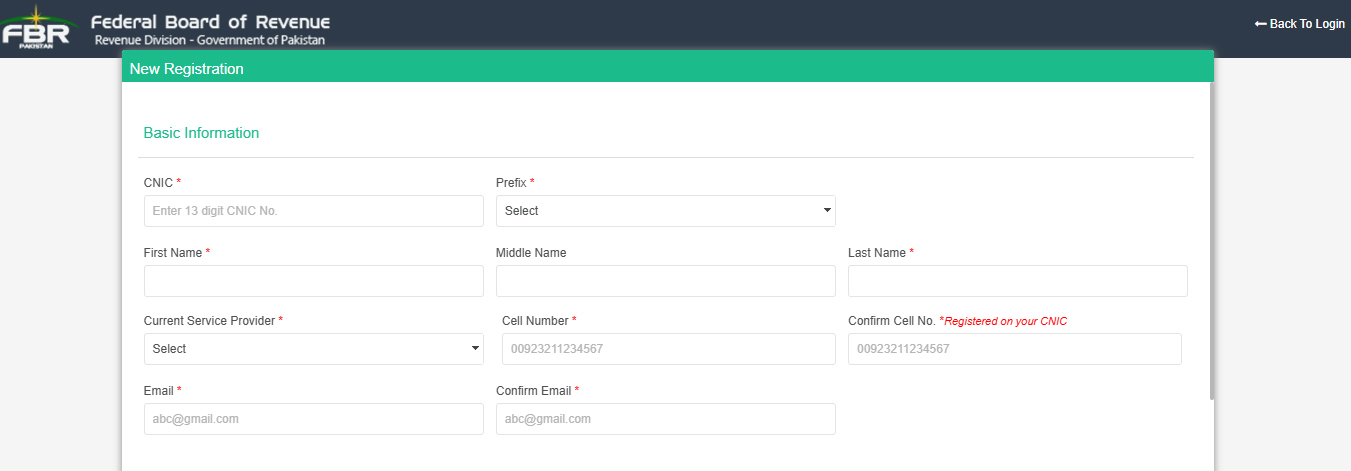

2. Enter Basic Information:

- CNIC: Enter your 13-digit CNIC (Computerized National Identity Card) number.

- Prefix: Choose the prefix (Mr./Ms./Mrs.) as per your CNIC.

- Full Name: Provide your first name, middle name, and last name exactly as it appears on your CNIC.

- Current Service Provider: Select your mobile network operator (e.g., Jazz, Telenor, Zong, Ufone).

- Cell Number: Enter the mobile number registered with your service provider.

- Confirm Cell Number: Re-enter your mobile number for verification.

- Email: Provide an active email address for correspondence.

- Confirm Email: Re-enter the email address to confirm it’s correct.

Pro Tips:�Use mobile number registered on your CNIC. Email address must be in your reach.

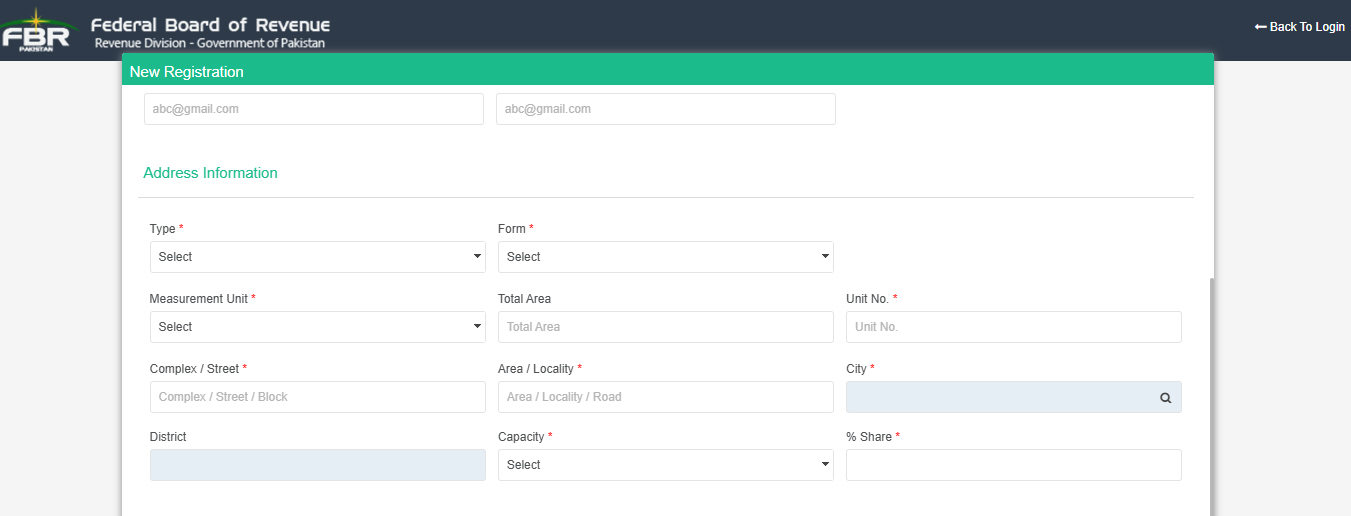

3. Enter Address Information:

- Type: Select the address type (e.g., Residential, Commercial).

- Address Form: Choose the format of your address (e.g., House No., Street Name).

- Measurement Unit: Select the unit of measurement (e.g., Marla, Square Feet).

- Total Area: Input the total area of the property in the chosen unit.

- Unit No.: If applicable, enter the unit number.

- Complex/Street Name: Mention the complex or street name where the property is located.

- Area/Locality: Specify the area or locality.

- City: Enter the city of residence.

- District: Select the district from the dropdown list.

- Capacity (if applicable): Select the property capacity, if relevant.

- % Share (if applicable): Mention your share percentage in the property.

Pro Tip:�Although you can change your address later, however, change of RTO is a complicated process. Therefore think twice before entering your address details as this will lock your RTO.

Pro Tip:�If you’re a tenant and using one portion of double storey house, enter 50% as shares after selecting Tenant in Capacity.

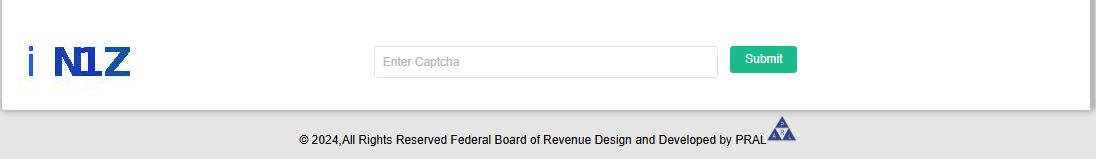

4. Captcha Verification:

- Enter the captcha code shown on the screen to verify you are a human and not a bot.

Pro Tip:�FBR Captcha is case-sensitive.

5. Submit the Application:

- Double-check all the information entered for accuracy.

- Click the Submit button to submit your NTN registration application.

Pro Tip:Ensure all information is accurate and matches official documents, such as your CNIC.

Manual Process (At Regional Tax Office – RTO):

If you prefer to register National Tax Number (NTN) manually, visit the nearest RTO of the FBR in your region. The FBR representative will review your documents. After successful verification, FBR will issue your NTN.

Tips for Compliance

- Engage a Tax Consultant: Professional advice ensures accurate filing and compliance with tax regulations.

- Stay Updated: Monitor changes in tax laws and FBR notifications to avoid inadvertent errors.

- File on Time: Avoid penalties by adhering to filing deadlines.

- Use Technology: Leverage the IRIS portal for efficient tax management and timely updates.

Avoid Common Pitfalls:

- Failing to maintain proper documentation, which may lead to discrepancies during audits.

- Submitting incomplete or inaccurate information in tax returns, risking application rejection or penalties.

- Neglecting to update your contact or business details with FBR, which may cause missed communications or compliance notices.

This guide provides a comprehensive understanding of the NTN process in Pakistan. For more personalized assistance or to address specific queries related to your NTN, feel free to consult TaxationPk or reach out to the FBR.